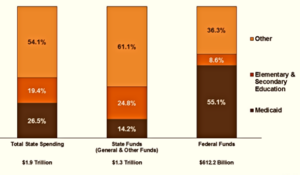

Everyone wants to be financially healthy, but this financial soundness comes with certain drawbacks such as increased taxes and disqualification from certain SSI and Medicaid benefits. A pooled trust can be the answer.

Not everyone who is financially sound can afford long-term medical care, given that it costs an arm and a leg to bear the hospital and facility expenses. Pooled trusts come to the rescue when you want to save your hard-earned money legally while making the most of public assistance benefits.

Understanding Pooled Trusts

It is a special kind of trust that enables people to become financially eligible for public assistance benefits while insulating their resources in a Pooled for special needs.

Usage of a Pooled Trust

Pooled Trusts can be used for several items, such as;

- Attorney/Guardian Fee

- Travel Expenses

- Medical Care (Not provided by the government)

- Nursing Care

- Housing Cost

- Real Estate Expenses (including taxes)

- Living Expenses (food, cloth, shelter, etc.)

Who Can Benefit?

Individuals who can benefit from joining a Pooled Trusts include:

- People with special needs

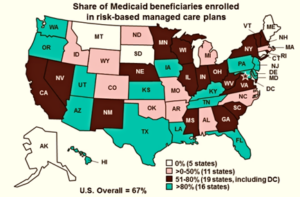

- Applicants/Recipients of various government benefit programs

- Older people who live at home

Eligibility for Joining A Pooled Trust

- Pooled Trust must meet legal requirements

- The beneficiary should be disabled as defined by law

- The trust must be created only for the benefit of the individual beneficiary

Consulting professionals who can help you through the planning options is always the recommended alternative.

Pooled Trust Key Take-Aways

The best way to learn is to speak with a qualified attorney. Our attorney can help you understand the nature of a Trust. Moreover, we also inform our clients to help them make better decisions.

Our attorney intends to keep helping the people who deserve to obtain public assistance benefits. Visit our website Kania Elder Law and share with us your state of affairs today. Free evaluation.